2023 mileage reimbursement rate

2023 mileage reimbursement rate

- Introduction

- Brief explanation of mileage reimbursement

Kilosin mile reimbursement is a method of reimbursing employees for the use of their personal vehicles for work-related travel. It is a common practice that ensures that damage to personal vehicles is justifiably recognized as well as expenses incurred on business-related trips. Employers typically pay based on a fixed rate per mile, after factoring in things like fuel, maintenance, insurance, and depreciation. This approach can provide companies with a fair compensation plan without having to provide a company car or cover all actual expenses for business travel Simplify the reimbursement process Keep accurate records, because times many it is necessary to record all travel information such as start and finish, purpose and total distance travelled.

- Importance of understanding and calculating mileage reimbursement rates

While the government does not require the U.S. employers reimburse employees who use their own vehicles to get work done, some companies are subject to federal requirements Surprisingly, federal law requires employers to reimburse their employees for all operating expenses, and if they do not which, can result in employee wages below the national minimum face legal issues and associated penalties. For this reason, it is advisable for businesses to check their state laws and seek legal advice before entering into mileage reimbursement arrangements.

There are many different ways to compensate your employees for the use of your own vehicle, and they all use standard IRS mileage as the basis for payment Before you go any further in ways among the various payment methods, here is everything you need to know about the standard IRS mileage .

- Introduction

- Brief explanation of mileage reimbursement

Kilosin mile reimbursement is a method of reimbursing employees for the use of their personal vehicles for work-related travel. It is a common practice that ensures that damage to personal vehicles is justifiably recognized as well as expenses incurred on business-related trips. Employers typically pay based on a fixed rate per mile, after factoring in things like fuel, maintenance, insurance, and depreciation. This approach can provide companies with a fair compensation plan without having to provide a company car or cover all actual expenses for business travel Simplify the reimbursement process Keep accurate records, because times many it is necessary to record all travel information such as start and finish, purpose and total distance travelled.

- Importance of understanding and calculating mileage reimbursement rates

While the government does not require the U.S. employers reimburse employees who use their own vehicles to get work done, some companies are subject to federal requirements Surprisingly, federal law requires employers to reimburse their employees for all operating expenses, and if they do not which, can result in employee wages below the national minimum face legal issues and associated penalties. For this reason, it is advisable for businesses to check their state laws and seek legal advice before entering into mileage reimbursement arrangements.

There are many different ways to compensate your employees for the use of your own vehicle, and they all use standard IRS mileage as the basis for payment Before you go any further in ways among the various payment methods, here is everything you need to know about the standard IRS mileage .

- Definition and Basics

Define what “Future directions: Mileage reimbursement practices on businesses and employees” is

In many careers, commercial enterprise travel is essential and is usually a requirement. To ease the weight, some companies offer personnel with corporation vehicles (which can be an costly perk), or reimburse a hard and fast quantity for every mile employees drive of their very own motors. The latter is called mileage compensation, and it’s far collectively beneficial for each personnel and employers.

- Explain how it is commonly used by businesses and organizations

=>Mileage compensation is a broadly adopted practice among corporations and groups, serving various functions to facilitate clean and price-powerful operations. Here’s an outline of ways it is normally used:

Business Travel:

One of the maximum common packages of mileage compensation is for employees who use their non-public cars for commercial enterprise-associated travel. This includes commuting to and from customer meetings, meetings, and different work-related locations.

Sales and Client Visits:

Sales experts and representatives often rely upon their personal automobiles to go to clients, potentialities, or companions. Mileage repayment guarantees that these personnel are compensated for the prices incurred whilst actively promoting the organisation’s services or products.

Field Service and Maintenance:

Organizations that provide discipline offerings or have personnel engaged in renovation work regularly use mileage repayment. This can include technicians, repair personnel, or carrier professionals who travel to consumer places to address troubles or perform installations.

Remote Work Support:

In the technology of faraway work, organizations may also amplify mileage repayment to employees who once in a while need to journey for work purposes, despite the fact that they in general make money working from home. This can encompass attending occasional in-man or woman meetings or training sessions.

Employee Recruitment and Training:

Companies may also reimburse mileage for personnel involved in the recruitment system or engaging in training classes. This ensures that those liable for bringing in new expertise or improving the capabilities of current personnel are correctly compensated.

Mention the reason of mileage reimbursement prices

• Reasonable compensation

• Cost recovery for employees

• Budget and cost control for business owners

• Compliance and legal requirements

• Clarity and consistency

• Motivation to travel efficiently

• Encouragement of sustainable practices

• Documentation and Accounting

- Definition and Basics

Define what “Future directions: Mileage reimbursement practices on businesses and employees” is

In many careers, commercial enterprise travel is essential and is usually a requirement. To ease the weight, some companies offer personnel with corporation vehicles (which can be an costly perk), or reimburse a hard and fast quantity for every mile employees drive of their very own motors. The latter is called mileage compensation, and it’s far collectively beneficial for each personnel and employers.

- Explain how it is commonly used by businesses and organizations

=>Mileage compensation is a broadly adopted practice among corporations and groups, serving various functions to facilitate clean and price-powerful operations. Here’s an outline of ways it is normally used:

Business Travel:

One of the maximum common packages of mileage compensation is for employees who use their non-public cars for commercial enterprise-associated travel. This includes commuting to and from customer meetings, meetings, and different work-related locations.

Sales and Client Visits:

Sales experts and representatives often rely upon their personal automobiles to go to clients, potentialities, or companions. Mileage repayment guarantees that these personnel are compensated for the prices incurred whilst actively promoting the organisation’s services or products.

Field Service and Maintenance:

Organizations that provide discipline offerings or have personnel engaged in renovation work regularly use mileage repayment. This can include technicians, repair personnel, or carrier professionals who travel to consumer places to address troubles or perform installations.

Remote Work Support:

In the technology of faraway work, organizations may also amplify mileage repayment to employees who once in a while need to journey for work purposes, despite the fact that they in general make money working from home. This can encompass attending occasional in-man or woman meetings or training sessions.

Employee Recruitment and Training:

Companies may also reimburse mileage for personnel involved in the recruitment system or engaging in training classes. This ensures that those liable for bringing in new expertise or improving the capabilities of current personnel are correctly compensated.

Mention the reason of mileage reimbursement prices

• Reasonable compensation

• Cost recovery for employees

• Budget and cost control for business owners

• Compliance and legal requirements

• Clarity and consistency

• Motivation to travel efficiently

• Encouragement of sustainable practices

• Documentation and accounting

- How Mileage Reimbursement Rates are Determined

Setting suitable mileage repayment charges entails considering different factors that together contribute to the general cost of the use of non-public motors for work-associated tour.

Gas Prices:

Fuel expenses are a vast element influencing reimbursement prices. Fluctuations in gas costs at once effect the overall expense incurred by using personnel at some stage in business tour. Higher gasoline fees might also necessitate adjustments in reimbursement quotes to make sure they cowl the improved fee of gasoline.

Vehicle Depreciation:

Depreciation represents the lower in a automobile’s fee through the years. When employees use their private vehicles for work-associated purposes, the automobile undergoes extra wear and tear, leading to increased depreciation. Reimbursement prices need to account for this loss in the automobile’s fee, ensuring honest reimbursement for personnel.

Maintenance and Repairs:

The put on and tear on a automobile because of business-related journey make contributions to accelerated preservation and restore costs. Reimbursement fees have to take into account these ongoing fees to offer adequate reimbursement for employees who use their personal vehicles for paintings.

Insurance Costs:

Business-associated tour might also impact coverage charges, as elevated mileage and publicity to different driving conditions pose additional dangers. Employers may additionally component in insurance charges whilst determining repayment charges to cover the capability boom in insurance charges for employees using non-public vehicles for work.

Vehicle Type and Model:

Different cars have varying gas efficiencies, protection necessities, and depreciation costs. Reimbursement rates can be adjusted based totally on the type and version of the car used for enterprise travel. For instance, a extra fuel-efficient or electric powered vehicle might warrant a distinct fee than a bigger, less green one.

Regional Cost Variations:

Costs related to vehicle possession and operation can vary by way of area. Factors together with local gasoline charges, renovation services, and insurance charges may additionally fluctuate geographically. Employers would possibly do not forget regional fee versions while setting repayment charges to mirror the neighbourhood monetary context.

Tax Implications:

Tax guidelines frequently affect reimbursement fees. Certain tax government may also specify well known mileage rates for tax functions, and employers may align their repayment fees with these requirements to ensure compliance and simplify tax reporting for each parties.

Corporate Policies and Budget Constraints:

Internal company regulations and budget constraints play a function in determining compensation costs. Organizations want to strike a stability between presenting truthful reimbursement to employees and dealing with average prices. Corporate regulations may also guide the selection-making method, thinking about the economic fitness of the business enterprise.

Environmental Considerations:

Some businesses select to comprise environmental considerations into their reimbursement policies. Offering better rates for fuel-efficient or green cars can incentivize personnel to make environmentally conscious alternatives, aligning with the organization’s sustainability goals.

- How Mileage Reimbursement Rates are Determined

Setting suitable mileage repayment charges entails considering different factors that together contribute to the general cost of the use of non-public motors for work-associated tour.

- Gas Prices:

Fuel expenses are a vast element influencing reimbursement prices. Fluctuations in gas costs at once effect the overall expense incurred by using personnel at some stage in business tour. Higher gasoline fees might also necessitate adjustments in reimbursement quotes to make sure they cowl the improved fee of gasoline. - Vehicle Depreciation:

Depreciation represents the lower in a automobile’s fee through the years. When employees use their private vehicles for work-associated purposes, the automobile undergoes extra wear and tear, leading to increased depreciation. Reimbursement prices need to account for this loss in the automobile’s fee, ensuring honest reimbursement for personnel. - Maintenance and Repairs:

The put on and tear on a automobile because of business-related journey make contributions to accelerated preservation and restore costs. Reimbursement fees have to take into account these ongoing fees to offer adequate reimbursement for employees who use their personal vehicles for paintings. - Insurance Costs:

Business-associated tour might also impact coverage charges, as elevated mileage and publicity to different driving conditions pose additional dangers. Employers may additionally component in insurance charges whilst determining repayment charges to cover the capability boom in insurance charges for employees using non-public vehicles for work. - Vehicle Type and Model:

Different cars have varying gas efficiencies, protection necessities, and depreciation costs. Reimbursement rates can be adjusted based totally on the type and version of the car used for enterprise travel. For instance, a extra fuel-efficient or electric powered vehicle might warrant a distinct fee than a bigger, less green one. - Regional Cost Variations:

Costs related to vehicle possession and operation can vary by way of area. Factors together with local gasoline charges, renovation services, and insurance charges may additionally fluctuate geographically. Employers would possibly do not forget regional fee versions while setting repayment charges to mirror the neighbourhood monetary context. - Tax Implications:

Tax guidelines frequently affect reimbursement fees. Certain tax government may also specify well known mileage rates for tax functions, and employers may align their repayment fees with these requirements to ensure compliance and simplify tax reporting for each parties. - Corporate Policies and Budget Constraints:

Internal company regulations and budget constraints play a function in determining compensation costs. Organizations want to strike a stability between presenting truthful reimbursement to employees and dealing with average prices. Corporate regulations may also guide the selection-making method, thinking about the economic fitness of the business enterprise. - Environmental Considerations:

Some businesses select to comprise environmental considerations into their reimbursement policies. Offering better rates for fuel-efficient or green cars can incentivize personnel to make environmentally conscious alternatives, aligning with the organization’s sustainability goals.

Different techniques used to calculate reimbursement rates

- IRS Standard Mileage Rate:

- Actual Expenses

- Fixed or Flat Rate

- Variable Rates Based on Distance

- Hybrid Approaches

- Geographic or Regional Rates

- Company-Owned Vehicle

- Environmental Considerations

Different techniques used to calculate reimbursement rates

- IRS Standard Mileage Rate

- Actual Expenses

- Fixed or Flat Rate

- Variable Rates Based on Distance

- Hybrid Approaches

- Geographic or Regional Rates

- Company-Owned Vehicle

- Environmental Considerations

- IRS Standard Mileage Rate

Explanation of the IRS Standard Mileage Rate:

The IRS widespread mileage charge is a predetermined amount set through the Internal Revenue Service (IRS) in the United States for calculating the deductible prices of operating a automobile for commercial enterprise, medical, moving, or charitable functions. This trendy rate simplifies the process of reimbursing individuals for the use of their private vehicles via offering a in step with-mile compensation rate that carries numerous prices related to automobile possession and operation.

As of my last know-how replace in January 2022, the standard mileage rate takes into consideration factors consisting of gas, maintenance, maintenance, coverage, and vehicle depreciation. It offers a standardized and simplified approach for each employers and personnel, doing away with the need for designated report-keeping of actual prices.

Current IRS Standard Mileage Rate:

It’s vital to observe that the IRS updates the usual mileage price annually, and fees can also change. As of my remaining understanding replace in January 2022, the usual mileage costs for the tax year 2022 had been as follows:

• Business Use: fifty six cents in line with mile

• Medical or Moving Purposes: 18 cents in line with mile

• Charitable Purposes: 14 cents per mile

To gain the most current trendy mileage charges, readers are recommended to test the ultra-modern updates on the professional IRS internet site or talk over with a tax expert.

- IRS Standard Mileage Rate

- Explanation of the IRS Standard Mileage Rate:

The IRS widespread mileage charge is a predetermined amount set through the Internal Revenue Service (IRS) in the United States for calculating the deductible prices of operating a automobile for commercial enterprise, medical, moving, or charitable functions. This trendy rate simplifies the process of reimbursing individuals for the use of their private vehicles via offering a in step with-mile compensation rate that carries numerous prices related to automobile possession and operation.

As of my last know-how replace in January 2022, the standard mileage rate takes into consideration factors consisting of gas, maintenance, maintenance, coverage, and vehicle depreciation. It offers a standardized and simplified approach for each employers and personnel, doing away with the need for designated report-keeping of actual prices. - Current IRS Standard Mileage Rate:

It’s vital to observe that the IRS updates the usual mileage price annually, and fees can also change. As of my remaining understanding replace in January 2022, the usual mileage costs for the tax year 2022 had been as follows:

• Business Use: fifty six cents in line with mile

• Medical or Moving Purposes: 18 cents in line with mile

• Charitable Purposes: 14 cents per mile

To gain the most current trendy mileage charges, readers are recommended to test the ultra-modern updates on the professional IRS internet site or talk over with a tax expert.

Pros and cons associated with the mileage option:

Pros and cons associated with the mileage option:

Pros:

Simplicity:

• One of the primary blessings of using the usual mileage fee is its simplicity. It gets rid of the need for employees to track and file character prices associated with their motors, making the reimbursement technique honest.

Consistency:

• The standard mileage price offers consistency for both employers and personnel. It offers a fixed fee consistent with mile for extraordinary purposes, making sure predictability in reimbursement calculations.

Accepted by using IRS:

• Using the IRS wellknown mileage fee presents a diploma of warranty, as it’s miles recognized and ordinary by way of the Internal Revenue Service. This can simplify tax reporting for both employers and employees.

Pros:

Simplicity:

• One of the primary blessings of using the usual mileage fee is its simplicity. It gets rid of the need for employees to track and file character prices associated with their motors, making the reimbursement technique honest.

Consistency:

• The standard mileage price offers consistency for both employers and personnel. It offers a fixed fee consistent with mile for extraordinary purposes, making sure predictability in reimbursement calculations.

Accepted by using IRS:

• Using the IRS wellknown mileage fee presents a diploma of warranty, as it’s miles recognized and ordinary by way of the Internal Revenue Service. This can simplify tax reporting for both employers and employees.

Cons:

May Not Reflect Actual Costs:

• One of the drawbacks is that the same old mileage rate won’t as it should be mirror the real charges incurred through all people. Some personnel may spend more on fuel, upkeep, or automobile depreciation than the standardized fee covers, whilst others may additionally spend less.

Vehicle Depreciation Considerations:

• The trendy mileage price carries an allowance for automobile depreciation, however it won’t align with the actual depreciation skilled by way of all cars. This can cause discrepancies for individuals with motors that depreciate at a charge drastically distinct from the standard.

Limited Flexibility:

• The wellknown mileage charge provides a set charge per mile, which may not accommodate variations in regional fuel charges, maintenance prices, or other factors that may vary broadly throughout locations.

Cons:

May Not Reflect Actual Costs:

• One of the drawbacks is that the same old mileage rate won’t as it should be mirror the real charges incurred through all people. Some personnel may spend more on fuel, upkeep, or automobile depreciation than the standardized fee covers, whilst others may additionally spend less.

Vehicle Depreciation Considerations:

• The trendy mileage price carries an allowance for automobile depreciation, however it won’t align with the actual depreciation skilled by way of all cars. This can cause discrepancies for individuals with motors that depreciate at a charge drastically distinct from the standard.

Limited Flexibility:

• The wellknown mileage charge provides a set charge per mile, which may not accommodate variations in regional fuel charges, maintenance prices, or other factors that may vary broadly throughout locations.

- Calculating Actual Expenses

Overview of Calculating Actual Expenses for Mileage Reimbursement:

Calculating mileage compensation based totally on actual charges entails considering various additives that make contributions to the overall fees incurred by way of employees when the use of their non-public vehicles for paintings-associated tour. Unlike the standardized technique of the IRS preferred mileage rate, this approach calls for employees to song and document precise fees related to their motors. Here’s an outline of key additives in calculating real fees:

Components of Actual Expenses:

a. Gas:

• The cost of gasoline is a sizeable element of real costs. Employees want to track their fuel costs associated with business journey. This consists of prices incurred for commuting to meetings, client visits, or other paintings-associated destinations.

B. Maintenance:

• Maintenance expenses encompass costs for habitual renovation and upkeep of the car. This includes oil adjustments, tire replacements, brake services, and other protection activities important to preserve the car in appropriate running condition.

C. Insurance:

• Insurance fees associated with using a private vehicle for commercial enterprise functions are part of actual costs. This includes premiums, deductibles, and any additional coverage required for work-related journey.

D. Depreciation:

• Depreciation represents the decrease inside the value of the car through the years due to wear and tear. Calculating depreciation for compensation purposes includes thinking about elements which include the vehicle’s initial value, expected lifespan, and contemporary marketplace price.

- Calculating Actual Expenses

Overview of Calculating Actual Expenses for Mileage Reimbursement:

Calculating mileage compensation based totally on actual charges entails considering various additives that make contributions to the overall fees incurred by way of employees when the use of their non-public vehicles for paintings-associated tour. Unlike the standardized technique of the IRS preferred mileage rate, this approach calls for employees to song and document precise fees related to their motors. Here’s an outline of key additives in calculating real fees:

Components of Actual Expenses:

a. Gas:

• The cost of gasoline is a sizeable element of real costs. Employees want to track their fuel costs associated with business journey. This consists of prices incurred for commuting to meetings, client visits, or other paintings-associated destinations.

B. Maintenance:

• Maintenance expenses encompass costs for habitual renovation and upkeep of the car. This includes oil adjustments, tire replacements, brake services, and other protection activities important to preserve the car in appropriate running condition.

C. Insurance:

• Insurance fees associated with using a private vehicle for commercial enterprise functions are part of actual costs. This includes premiums, deductibles, and any additional coverage required for work-related journey.

D. Depreciation:

• Depreciation represents the decrease inside the value of the car through the years due to wear and tear. Calculating depreciation for compensation purposes includes thinking about elements which include the vehicle’s initial value, expected lifespan, and contemporary marketplace price.

Documentation Required for Actual Expense Reimbursement:

a. Mileage Tracking:

• Employees ought to preserve an correct log in their mileage for every business-associated journey. This log should include details including the starting and ending places, purpose of the trip, and total miles traveled.

B. Fuel Receipts:

• Retaining receipts for fuel purchases is critical for documenting real gasoline expenses. These receipts ought to specify the amount of fuel bought, the date, and the place.

C. Maintenance and Repair Receipts:

• Employees should preserve receipts for any renovation or repair offerings performed at the car. This documentation helps claims for reimbursement of actual costs associated with vehicle upkeep.

D. Insurance Documents:

• Providing copies of coverage policies, top class payment data, and any additional insurance associated with business use of the automobile is crucial for compensation based totally on real coverage prices.

E. Depreciation Calculation:

• Calculating depreciation requires information about the preliminary value of the vehicle, its predicted lifespan, and the modern market cost. This documentation enables set up an affordable depreciation amount for reimbursement.

F. Regular Expense Reports:

• Employees might also want to publish regular rate reviews that element their actual prices for repayment. These reports ought to provide a clean breakdown of every rate class, assisting documentation, and a total compensation amount requested.

Considerations:

• Employers ought to set up clean guidelines and hints for documenting actual costs to make sure consistency and accuracy in the repayment manner.

• Periodic audits or evaluations of rate documentation can help preserve compliance and transparency inside the compensation technique.

• It’s important to talk expectations regarding the submission of documentation and the compensation procedure to employees to avoid misunderstandings.

Documentation Required for Actual Expense Reimbursement:

A. Mileage Tracking:

• Employees ought to preserve an correct log in their mileage for every business-associated journey. This log should include details including the starting and ending places, purpose of the trip, and total miles traveled.

B. Fuel Receipts:

• Retaining receipts for fuel purchases is critical for documenting real gasoline expenses. These receipts ought to specify the amount of fuel bought, the date, and the place.

C. Maintenance and Repair Receipts:

• Employees should preserve receipts for any renovation or repair offerings performed at the car. This documentation helps claims for reimbursement of actual costs associated with vehicle upkeep.

D. Insurance Documents:

• Providing copies of coverage policies, top class payment data, and any additional insurance associated with business use of the automobile is crucial for compensation based totally on real coverage prices.

E. Depreciation Calculation:

• Calculating depreciation requires information about the preliminary value of the vehicle, its predicted lifespan, and the modern market cost. This documentation enables set up an affordable depreciation amount for reimbursement.

F. Regular Expense Reports:

• Employees might also want to publish regular rate reviews that element their actual prices for repayment. These reports ought to provide a clean breakdown of every rate class, assisting documentation, and a total compensation amount requested.

Considerations:

• Employers ought to set up clean guidelines and hints for documenting actual costs to make sure consistency and accuracy in the repayment manner.

• Periodic audits or evaluations of rate documentation can help preserve compliance and transparency inside the compensation technique.

• It’s important to talk expectations regarding the submission of documentation and the compensation procedure to employees to avoid misunderstandings.

6. Tips for maximizing mileage

Keep accurate records:

It is important to keep detailed and accurate mileage records. Use mileage tracking apps or keep a dedicated logbook to record start and finish points, travel purposes and total mileage. Accurate documentation is necessary to maximize payment within legal limits.

Understand the company policies:

Familiarize yourself with your company’s mileage reimbursement policies. Knowing what reimbursement is available, what costs are appropriate, and any specific guidelines will help you fit within the legal framework your employer has in place.

Choose the right car:

If you have multiple vehicles, consider using a fuel-efficient vehicle for business-related travel. Some companies may offer higher rates for fuel-efficient or electric vehicles, maximizing rates while helping to sustain the environment

Strategies for efficiency:

Plan your routes carefully to cover as many miles as possible without compromising productivity. Reduce overall distance by combining multiple activities into one trip. Use mapping applications with real-time traffic updates to choose the fastest routes and avoid unnecessary trips.

Car pooling and car sharing:

If possible, explore options for carpooling or with colleagues attending the same event or event. Not only does sharing a car reduce individual distances, it can help save costs and adopt a more sustainable path.

Plan Off-Peak Travel:

Consider scheduling your journeys at some stage in off-peak hours to avoid heavy site visitors and decrease journey time. This no longer only improves performance however also can result in fuel financial savings and less wear and tear for your car.

Regular Vehicle Maintenance:

Keep your vehicle properly-maintained to optimize fuel efficiency and reduce the likelihood of unexpected breakdowns. Regular protection, consisting of well timed oil adjustments, tire rotations, and brake checks, contributes to average value savings and ensures you’re maximizing compensation for a properly-maintained car.

Explore Alternative Transportation:

Depending on the nature of your work, explore alternatives like public transportation, biking, or strolling for shorter distances. Some employers might also offer reimbursement for these modes of transportation, allowing you to diversify your commuting alternatives.

Document Personal and Business Use:

Clearly distinguish among personal and commercial enterprise use of your vehicle. Accurate documentation ensures that only work-related mileage is considered for repayment, preventing any capacity discrepancies.

Stay Informed approximately Tax Deductions:

Familiarize your self with tax guidelines related to mileage deductions. While your enterprise’s reimbursement can also cowl many costs, there will be extra deductions at the tax level. Consult with a tax expert to make certain you are maximizing deductions inside felony limits.

Attend Virtual Meetings:

In instances wherein bodily presence isn’t always obligatory, recall attending conferences truly. Virtual conferences may be a fee-effective and time-green alternative, decreasing the need for vast tour and maximizing compensation for important in-character events.

Future directions: Mileage reimbursement practices on businesses and employees

2020 year | 2021 year | |||

Vehicle Type | Tier One Rate | Tier Two Rate | Tier One Rate | Tier Two Rate |

Petrol or Diesel | 82 cents | 28 cents | 79 cents | 27 cents |

Petrol Hybrid | 82 cents | 17 cents | 79 cents | 16 cents |

Electric | 82 cents | 09 cents | 79 cents | 09 cents |

6. Tips for maximizing mileage

Keep accurate records:

It is important to keep detailed and accurate mileage records. Use mileage tracking apps or keep a dedicated logbook to record start and finish points, travel purposes and total mileage. Accurate documentation is necessary to maximize payment within legal limits.

Understand the company policies:

Familiarize yourself with your company’s mileage reimbursement policies. Knowing what reimbursement is available, what costs are appropriate, and any specific guidelines will help you fit within the legal framework your employer has in place.

Choose the right car:

If you have multiple vehicles, consider using a fuel-efficient vehicle for business-related travel. Some companies may offer higher rates for fuel-efficient or electric vehicles, maximizing rates while helping to sustain the environment

Strategies for efficiency:

Plan your routes carefully to cover as many miles as possible without compromising productivity. Reduce overall distance by combining multiple activities into one trip. Use mapping applications with real-time traffic updates to choose the fastest routes and avoid unnecessary trips.

Car pooling and car sharing:

If possible, explore options for carpooling or with colleagues attending the same event or event. Not only does sharing a car reduce individual distances, it can help save costs and adopt a more sustainable path.

Plan Off-Peak Travel:

Consider scheduling your journeys at some stage in off-peak hours to avoid heavy site visitors and decrease journey time. This no longer only improves performance however also can result in fuel financial savings and less wear and tear for your car.

Regular Vehicle Maintenance:

Keep your vehicle properly-maintained to optimize fuel efficiency and reduce the likelihood of unexpected breakdowns. Regular protection, consisting of well timed oil adjustments, tire rotations, and brake checks, contributes to average value savings and ensures you’re maximizing compensation for a properly-maintained car.

Explore Alternative Transportation:

Depending on the nature of your work, explore alternatives like public transportation, biking, or strolling for shorter distances. Some employers might also offer reimbursement for these modes of transportation, allowing you to diversify your commuting alternatives.

Document Personal and Business Use:

Clearly distinguish among personal and commercial enterprise use of your vehicle. Accurate documentation ensures that only work-related mileage is considered for repayment, preventing any capacity discrepancies.

Stay Informed approximately Tax Deductions:

Familiarize your self with tax guidelines related to mileage deductions. While your enterprise’s reimbursement can also cowl many costs, there will be extra deductions at the tax level. Consult with a tax expert to make certain you are maximizing deductions inside felony limits.

Attend Virtual Meetings:

In instances wherein bodily presence isn’t always obligatory, recall attending conferences truly. Virtual conferences may be a fee-effective and time-green alternative, decreasing the need for vast tour and maximizing compensation for important in-character events.

Future directions: Mileage reimbursement practices on businesses and employees

2020 year | 2021 year | |||

Vehicle Type | Tier One Rate | Tier Two Rate | Tier One Rate | Tier Two Rate |

Petrol or Diesel | 82 cents | 28 cents | 79 cents | 27 cents |

Petrol Hybrid | 82 cents | 17 cents | 79 cents | 16 cents |

Electric | 82 cents | 09 cents | 79 cents | 09 cents |

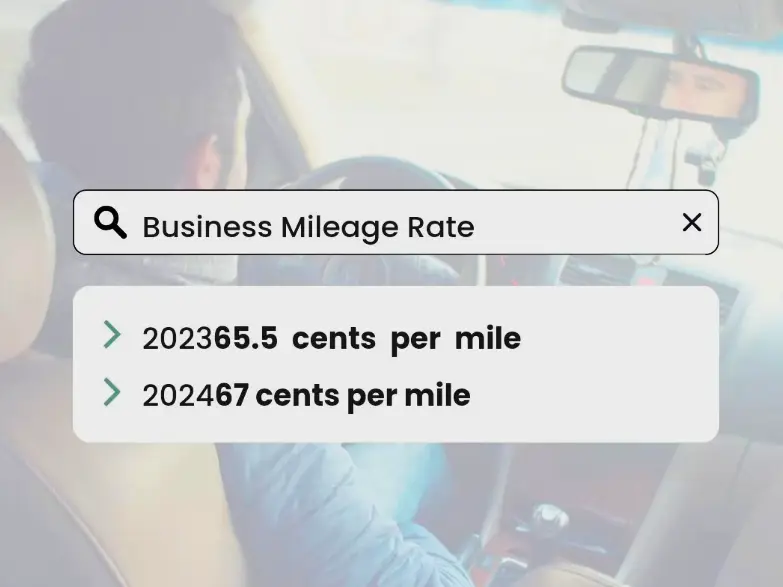

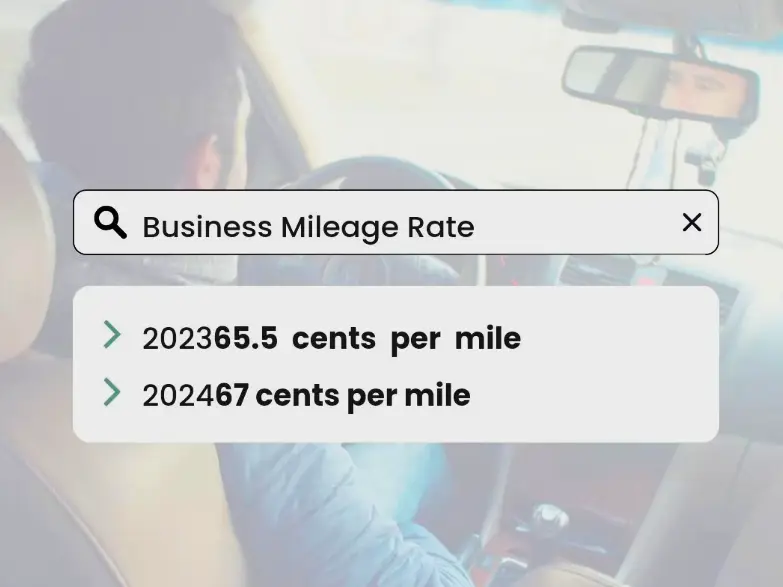

Is It Really Increasing by 1.5 Cents?

The IRS raised the mileage charge with the aid of 1.5 cents from 2023 to sixty seven cents a mile in a launch on Thursday. The following widespread mileage rates will follow from January 1, 2024, for the use of an automobile (which includes vans, pickups, and panel vehicles):

- A 1.Five cent increase from 2023 to 67 cents per mile driven for enterprise functions.

- 21 cents in step with mile for qualifying lively-obligation contributors of the defense force who drive for scientific or relocation functions; that is a one-cent drop from 2023.

- 14 cents per mile for nonprofit businesses; this price is constant via statute and won’t alternate after 2023.

According to the IRS, petrol and diesel cars in addition to electric and hybrid cars are concern to the tariffs. In the press release, the authorities company reminded taxpayers that instead of making use of the everyday mileage charges, they always have the option to calculate the genuine expenses of working their automobile.

Is It Really Increasing by 1.5 Cents?

The IRS raised the mileage charge with the aid of 1.5 cents from 2023 to sixty seven cents a mile in a launch on Thursday. The following widespread mileage rates will follow from January 1, 2024, for the use of an automobile (which includes vans, pickups, and panel vehicles):

- A 1.Five cent increase from 2023 to 67 cents per mile driven for enterprise functions.

- 21 cents in step with mile for qualifying lively-obligation contributors of the defense force who drive for scientific or relocation functions; that is a one-cent drop from 2023.

- 14 cents per mile for nonprofit businesses; this price is constant via statute and won’t alternate after 2023.

According to the IRS, petrol and diesel cars in addition to electric and hybrid cars are concern to the tariffs. In the press release, the authorities company reminded taxpayers that instead of making use of the everyday mileage charges, they always have the option to calculate the genuine expenses of working their automobile.

Conclusion

Conclusion

This is considerable due to the fact you might be required to provide a log of your pushed kilometers as evidence of your deduction in the event of an audit. You may also track your miles in quite a few approaches.

Although retaining a pen and paper within the glove container may be sufficient, there are many different gear which could make things less complicated. All you need to do is take a quick examine Google or the app store for your phone.

We are extremely satisfied that you have granted us the possibility to help you understand approximately IRS Mileage Reimbursement Rate 2024, please maintain returning for associated stuff.

This is considerable due to the fact you might be required to provide a log of your pushed kilometers as evidence of your deduction in the event of an audit. You may also track your miles in quite a few approaches.

Although retaining a pen and paper within the glove container may be sufficient, there are many different gear which could make things less complicated. All you need to do is take a quick examine Google or the app store for your phone.

We are extremely satisfied that you have granted us the possibility to help you understand approximately IRS Mileage Reimbursement Rate 2024, please maintain returning for associated stuff.

About the author

Sudipta Sardar Contributing Writer

Sudipta Sardar is a passionate blogger and content creator who has written on a wide range of technology topics, with a focus on Online shopping deals and product reviews. He graduated with a B.Tech in Electrical Engineering and enjoys coding and exploring the latest gadgets

About the author

Sudipta Sardar Contributing Writer

Sudipta Sardar is a passionate blogger and content creator who has written on a wide range of technology topics, with a focus on Online shopping deals and product reviews. He graduated with a B.Tech in Electrical Engineering and enjoys coding and exploring the latest gadgets